February 27, 2018 — Kenya is one of 34 countries that have introduced banking reforms to expand sustainable lending, making emerging markets a major force in driving development and fighting climate change.

This is according to the first comprehensive Global Progress Report of the Sustainable Banking Network, an IFC-supported organization of banking regulators and associations.

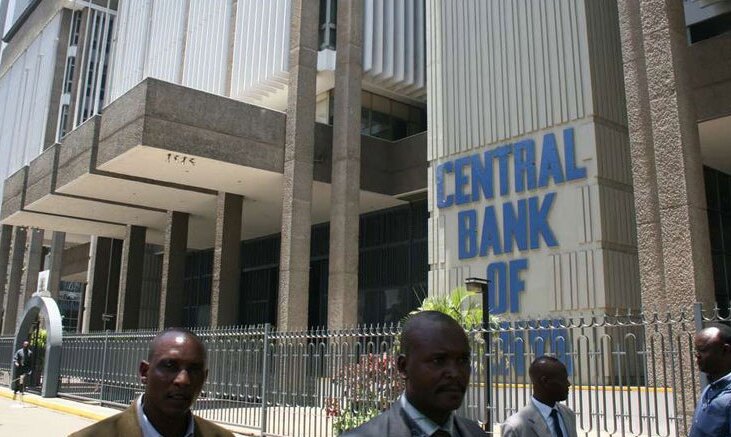

Those 34 countries account for $42.5 trillion in bank assets—more than 85 percent of total bank assets in emerging markets. Some are wealthier than others, but all of them have made progress in advancing sustainable finance. Eight countries—Bangladesh, Brazil, China, Colombia, Indonesia, Mongolia, Nigeria, and Viet Nam—have reached an advanced stage, having implemented large-scale reforms and put in place systems for results measurement. Kenya is currently developing a comprehensive sustainable finance initiative covering the entire financial sector. Read more.