*New* SBFN Data Portal

The new SBFN Data portal is the most comprehensive database of sustainable finance initiatives in emerging markets and developing economies, enabling regular and consistent monitoring and benchmarking across countries, regions, and indicators.

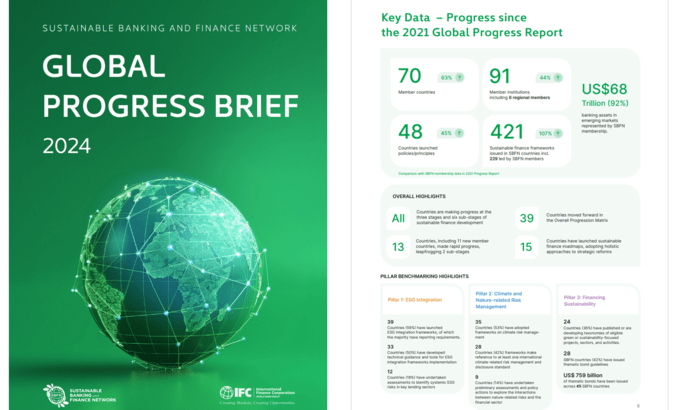

2024 SBFN Global Progress Brief

The 2024 SBFN Global Progress Brief, offers a comprehensive benchmarking of sustainable finance trends and innovations across 66 member countries covering three pillars of sustainable finance: Environmental, Social, and Governance (ESG) Integration, Climate and Nature-Related Risk Management, and Financing Sustainability.

*New* SBFN Data Portal

The new SBFN Data portal is the most comprehensive database of sustainable finance initiatives in emerging markets and developing economies, enabling regular and consistent monitoring and benchmarking across countries, regions, and indicators.

2024 SBFN Global Progress Brief

The 2024 SBFN Global Progress Brief, offers a comprehensive benchmarking of sustainable finance trends and innovations across 66 member countries covering three pillars of sustainable finance: Environmental, Social, and Governance (ESG) Integration, Climate and Nature-Related Risk Management, and Financing Sustainability.

Featured SBFN Member Stories

Watch our members share inspiring insights with the SBFN community on their sustainable finance journey, their key achievements, as well as their vision for the future of the network and sustainable finance in their countries, regions, and globally.

In the latest testimony, Mr Koba Gvenetadze, the outgoing Governor of the National Bank of Georgia shares his organization’s journey in transforming ideas into measurable outcomes, guided by the sustainable finance roadmap and in partnership with SBFN and IFC.

The Sustainable Banking and Finance Network (SBFN) is a platform for knowledge sharing and capacity building on sustainable finance for financial sector regulators and industry associations across emerging markets.

Facilitated by IFC as secretariat, and supported by the World Bank Group, SBFN helps mobilize information, resources, and practical support for members to design and implement national initiatives that advance sustainable finance at national, regional, and global levels.

Members are committed to moving their financial sectors towards sustainability, with the twin goals to:

Improve the management of environmental, social, and governance (ESG) risks – including climate risks – across the financial sector.

Increase capital flows to activities with positive environmental and social impacts, including climate change mitigation and adaptation.

Member

Countries

Member

Institutions

Banking Assets

Supervised

SBFN 2021 Global Progress Report and Country Reports

and

Evidence of Policy Innovations and Market Actions for Sustainable Finance across 62 Emerging Markets

What's New

New Sustainable Banking and Finance Network Research Reveals Rapid Policy Reforms as Catalyst for Expanding Sustainable Finance in Emerging Markets

The 2024 Global Progress Brief highlights key achievements, challenges, and opportunities within the SBFN community across three pillars of sustainable finance defined in the SBFN Measurement Framework developed by members: Environmental, Social, and Governance (ESG) Integration, Climate and Nature-Related Risk Management, and Financing Sustainability.

Association of Montenegrin Banks Joins SBFN to Further Enhance Sustainable Finance Efforts

AMB, a non-profit organization dedicated to improving the performance of the banking sector in Montenegro, has demonstrated remarkable dedication and tangible progress in fostering an environment conducive to sustainable finance. Notably, AMB has spearheaded various sustainability initiatives within the banking sector, including the Green Finance Forum, a collaborative effort with the Chamber of Commerce of Montenegro. This platform provided banks with an opportunity to showcase sustainable finance projects, with a particular focus on empowering young entrepreneurs and women in business.

Bank of Papua New Guinea Joins SBFN, Bolstering Global Sustainable Finance Efforts

In an effort to raise environmental, social and governance (ESG) standards, BPNG actively encouraged sustainability initiatives within the banking sector and launched the Inclusive Green Finance Policy (IGFP) project initiative in 2021, aiming to deepen insights into climate resilience and inclusive green growth in Papua New Guinea. A cornerstone of this effort is the establishment of a dedicated Green Finance Center by BPNG to spearhead the implementation of the IGFP and drive green finance-related initiatives.

Working Groups

Currently four member-led thematic working groups are established within SBFN

The Sustainable Banking and Finance Network

Evidence of Policy Innovations and

Market Actions across 62 Emerging Markets.

The Sustainable Banking and Finance Network (SBFN) is a platform for knowledge sharing and capacity building on sustainable finance for financial sector regulators and industry associations across emerging markets.

Facilitated by IFC as secretariat, and supported by the World Bank Group, SBFN helps mobilize information, resources, and practical support for members to design and implement national initiatives that advance sustainable finance at national, regional, and global levels.

Member

Countries

Member

Institutions

Banking Assets

Supervised

What's New

New Sustainable Banking and Finance Network Research Reveals Rapid Policy Reforms as Catalyst for Expanding Sustainable Finance in Emerging Markets

The 2024 Global Progress Brief highlights key achievements, challenges, and opportunities within the SBFN community across three pillars of sustainable finance defined in the SBFN Measurement Framework developed by members: Environmental, Social, and Governance (ESG) Integration, Climate and Nature-Related Risk Management, and Financing Sustainability.

Association of Montenegrin Banks Joins SBFN to Further Enhance Sustainable Finance Efforts

AMB, a non-profit organization dedicated to improving the performance of the banking sector in Montenegro, has demonstrated remarkable dedication and tangible progress in fostering an environment conducive to sustainable finance. Notably, AMB has spearheaded various sustainability initiatives within the banking sector, including the Green Finance Forum, a collaborative effort with the Chamber of Commerce of Montenegro. This platform provided banks with an opportunity to showcase sustainable finance projects, with a particular focus on empowering young entrepreneurs and women in business.

Bank of Papua New Guinea Joins SBFN, Bolstering Global Sustainable Finance Efforts

In an effort to raise environmental, social and governance (ESG) standards, BPNG actively encouraged sustainability initiatives within the banking sector and launched the Inclusive Green Finance Policy (IGFP) project initiative in 2021, aiming to deepen insights into climate resilience and inclusive green growth in Papua New Guinea. A cornerstone of this effort is the establishment of a dedicated Green Finance Center by BPNG to spearhead the implementation of the IGFP and drive green finance-related initiatives.

Members

80 financial sector regulators and industry associations from 63 countries in emerging markets

Working Groups

Currently four member-led thematic working groups are established within SBFN